what is the formula to calculate net income

Taxable Income Formula (Tabular array of Contents)

- Formula

- Examples

- Calculator

What is Taxable Income Formula?

This article volition talk near the Taxable Income Formula and Here we learn the calculation of Taxable Income along with the various important Examples.

Taxable Income is the corporeality of income which is liable to tax. It ways how much income of an individual or company owes to the government in the current tax year. Gross Income or Adjusted Gross Income or Net Income is the income an individual gets from the employer before any deductions or taxes. Mail service deduction is the net income. In India, a person's income that crosses the maximum amount limit is nerveless as Income tax based on the rate set by the Indian income tax department. It is based on the Individual Resident Status of the taxpayer too. Indian Income does always have a tax liability. Foreign Income besides comes under tax liability for Residents only not for non-residents. Income tin exist divided into two categories. 1. Earned Income 2. Unearned Income. Earned Income includes Salaries, Provident fund contribution, fees, pension, gratuity, tips, bonus, etc. Unearned Income includes rents, alimony, interests, royalties, dividends, etc. Merely we can dissever the Income like beneath.

- a) From Salary

- b) From Fixed Assets like properties.

- c) From Business or Profession

- d) From Share Markets or investment Gains

- e) From Other Resources, if any

Now the Gross Income is additional of all the in a higher place any is applicable.

Gross Total Income = a+b+c+d+e

Income tax tin be calculated using the simple formula. It is purely based on the income tax slabs it falls under.

Formula For Taxable Income is represented equally,

Total Taxable Income = Gross Total Income – Deductions / Exemptions allowed from income

Examples of Taxable Income Formula (With Excel Template)

Permit's have an instance to understand the calculation of Taxable Income in a better fashion.

Y'all can download this Taxable Income Formula Excel Template here – Taxable Income Formula Excel Template

Taxable Income Formula – Example #ane

Reena has income from Salary, Business, and Property. She gets the Full Income salary of Rs.3L post all possible deductions/ exemptions. And Income from a style boutique is Rs.50000 afterward all exemptions. And Property Hire of Rs.60000. She invested in 80c for 15000. Hence claimed for 80 C.

Solution:

Gross Total Income is calculated as:

- Gross Total Income = 300000+50000+60000 – 15000

- Gross Full Income = 395000

Full Taxable Income is calculated using the formula given beneath

Total Taxable Income = Gross Total Income – Deductions / Exemptions allowed from Income

- Total Taxable Income = 395000 – 0

- Total Taxable Income = 395000

Taxable Income Formula – Example #2

The income tax calculation for the Salaried

Income From salary is the summation of Basic Salary, House Rent Assart, Special Allowance, Transport Allowance, Other If any. Some Parts of bacon are taxation exempted such as phone bills, Leave travel allowance. In addition to this, the Standard deduction of 50000 is there in the Budget 2019.

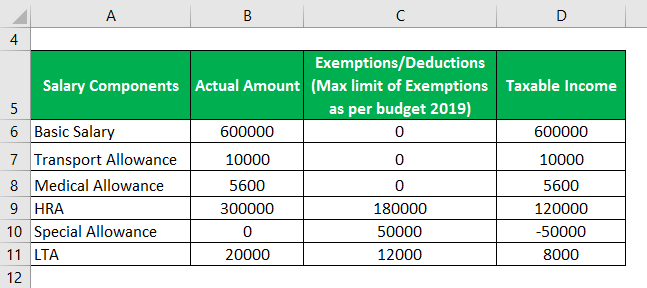

Veera lives in Bangalore and gets a basic Salary of Rs.600000 a month. HRA of Rs.300000 and Transport Allowances of Rs.10000 and medical allowances of Rs.5600. Phone Bills Rs.20000 Annually. Veera pays Hire of Rs.20000. Beneath is the calculation of how the taxable income from salary is calculated.

Taxable income is calculated as

Similarly, we call for other values

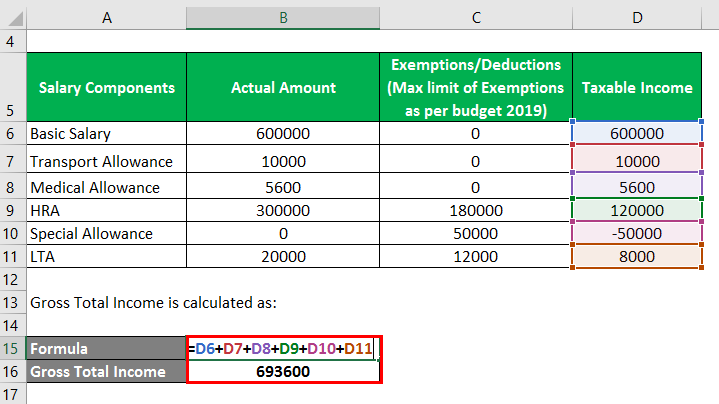

Gross Total Income is calculated as:

- Gross Total Income = 600000 + 10000 + 5600 + 120000 – 50000 + 8000

- Gross Total Income = 693600

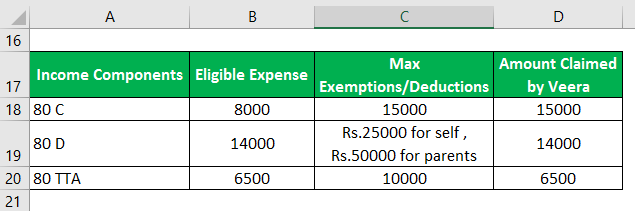

Veera has income from involvement from the savings account of Rs.6500 during the year. Neha has invested nether 80C to save some taxation Edelweiss Tokio Life Insurance premium of Rs.8000. Medical insurance paid of Rs.14000. Veera Can claim the following Deductions.

Income from Other Sources:

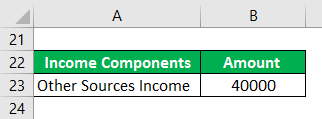

Veera has income from other sources of Rs.40000 annually.

Full Taxable Income is calculated using the formula given below

Full Taxable Income = Gross Total Income – Deductions / Exemptions allowed from Income

- Full Taxable Income = 693600 + 40000 – (15000 + 14000 + 6500)

- Full Taxable Income = 733600 – 35500

- Full Taxable Income = 698100

Explanation

Here is the stride by step approach for computing Taxable Income.

Step one: Gross Income- Gross Income is the income amount an individual gets from the employer or a company gets before any deductions or taxes. And then information technology volition be an additional of all income which a person/visitor would have perchance got through a) salary or b)property or c) business or d) capital gains or e) other resources.

Gross Total Income = a+b+c+d+e

Step 2: Deductions or Exemptions-The exemption or Deductions value has to be deducted from the gross income. In that location are certain allowances which are fully taxable or partly taxable or fully exempted taxable allowances.

Fully taxable – Some of the fully Taxable allowances are Overtime Assart, Servant Assart, and Dearness Assart.

Partly Taxable – Examples for Partly Taxable are House Hire Assart, Travel Assart, Uniform Allowance, and Children Teaching Allowances.

Fully Exempted Taxable – Some of the Fully Exempted Allowances are Allowances of High Court & Supreme court Judges, Strange Allowances. Based on the Category a detail assart falls nether, it is deducted from the gross income.

Step 3: Net Income or Taxable Income: Income amount which is deducted from the suitable allowances is Internet Income.

Footstep four: Later finding the internet income, based on under which Income range slabs, the corporeality comes, the Taxes are calculated. 1 can refer to the above income tax slab tabular array for this.

Total Taxable Income or Net Income = Gross Total Income – Deductions / Exemptions allowed from Income

Relevance and Uses of Taxable Income Formula

Mainly The Taxable Income is used to observe the tax we have to pay to Authorities equally an individual or Company. The taxes are mainly used for raising the revenue of the authorities and other purposes besides. So it is mainly for Public Finance. When the overall monetary is the status of a state is compared with other countries, the revenue is considered. Taxes of its citizens hold the principal place in it.

Taxable Income Formula Calculator

Y'all can use the post-obit Taxable Income Formula Reckoner

| Gross Total Income | |

| Deductions | |

| Total taxable Income | |

| Full taxable Income = | Gross Full Income – Deductions |

| = | 0 – 0 |

| = | 0 |

Recommended Manufactures

This is a guide to Taxable Income Formula. Here nosotros hash out how to calculate Taxable Income along with the practical examples. Nosotros besides provide a Taxable Income estimator with a downloadable excel template. Y'all may also look at the following manufactures to learn more –

- Formula for Internal Growth Charge per unit

- Coverage Ratio Formula Excel Template

- Calculation of Effective Tax Charge per unit

- Examples of Correlation Formula

- Gross Income Formula

- Capital Gain FormulaCalculator (Examples with Excel Template)

- Difference betwixt Taxation Shelter and Tax Evasion

- Tax Multiplier Formula with Examples

Source: https://www.educba.com/taxable-income-formula/

0 Response to "what is the formula to calculate net income"

Postar um comentário